How To Calculate Profit In Forex

Reading time: eight minutes

With a daily book of $6.6 trillion, strange exchange is the largest financial market in the world.

Arranged as a decentralised auction firm for currencies, FX trading offers unparalleled opportunities for informed traders and investors.

As a Forex trader, amidst other things, knowing the process backside calculating profits and losses is vital.

Currency Pairs: The Nuts

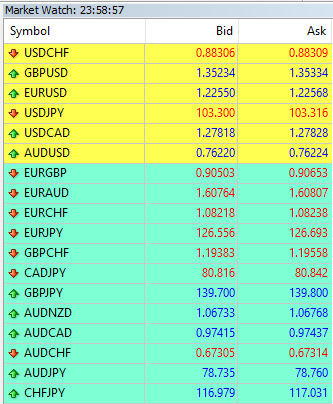

The Forex market functions through currency pairs, a quotation displaying 2 currencies. On MetaTrader trading platforms, currency pair quotes can be viewed in the Marketplace Watch characteristic (Ctrl+M), offering real-time bid and inquire prices. The bid price displays willing buyers – a trader'southward selling toll. The ask toll (or sometimes referred to as the offer cost) is the price of willing sellers – a trader's buying price. The spread between the ii prices is known as the bid/ask spread, which is typically the broker'southward commission.

EUR/USD (Euro / US dollar) is a widely traded currency pair. According to the 2019 Triennial Central Bank Survey of FX and OTC derivatives markets, the Us dollar and euro take the lion's share in terms of turnover.

The euro, in the case of EUR/USD, represents the base of operations currency (the commencement currency listed); the United states dollar is known as the counter, or quote, currency. The base of operations currency in all currency pairs ever represents 1 unit. The quote currency indicates the value, or the cost, to buy the base currency. For example, EUR/USD trading at $1.2256 ways to buy 1 euro in USD costs 1.22 USD (rounded).

A retail trader inbound long EUR/USD is effectively betting the euro will advance against the The states dollar. Assume the exchange rate for EUR/USD is $1.2160 at entry. If this value rises to $1.2170 this represents a 10-pip gain. A decline to $1.2150, on the other manus, represents a 10-pip loss. Conversely, a retail trader entering a short position in EUR/USD is betting the euro volition refuse vs. the dollar.

Understanding Pip Value and Position Size

A pip, or toll interest point, measures the currency pair's fluctuation, equal to i/100th of 1%. Most currency pairs are ordinarily priced to four decimal places (0.0001). Currency pairs containing Japanese yen (JPY) are priced to 2 decimal places (0.01).

Position size refers to units traded. In other words, the notional value of the position, ofttimes referred to as lots. Don't confuse this with leverage. Leverage is a stock-still ratio offered by the broker; it allows you lot to merchandise a position size greater than your account disinterestedness. Opting for higher leverage allows the trader to deposit less initial margin, or put upwardly a smaller amount of upper-case letter; conversely, lower leverage requires a greater amount of initial margin. The bottom line is altering leverage does not change the number of lots (position size), it affects how much of your account equity is used to open up a position, the initial margin.

In Forex, most brokerages offer micro, mini and standard lots. A micro lot refers to ane,000 units of the base currency, a mini lot x,000 units and a standard lot 100,000 units.

While many traders apply a pip value reckoner, below is the manual calculation for pip value:

If the quote currency is the same as the account currency (USD, for example), pip values are 0.10 USD each pip movement for a micro lot. A mini lot (10,000 units) equals 1.00 USD per pip and a standard lot (100,000 units) represents ten.00 USD per pip.

If the business relationship currency is the same as the base currency, the pip value is found past dividing 1 pip (0.0001) by the currency pair'south rate and multiplying this value past the lot size (units traded).

If the account currency is not included in the currency pair, this involves effectively switching the account currency to the base currency of the currency pair y'all wish to trade. As an example, a trader with an account denominated in GBP that wishes to trade CAD/CHF must locate the rate for GBP/CHF. The trader can and then perform the same calculation as demonstrated above using the GBP/CHF rate (the account currency now represents the base currency).

Forex Trading: Profit and Loss

By understanding pip value and position size, you're able to summate the profit and loss of a position. However, to obtain a final turn a profit/loss value, you must cistron in swap rates (if open positions are left agile overnight [beyond 5pm EST]) and commissions.

Another of import bespeak to understand is a winning or losing merchandise is unrealized profit/loss (potential profit or loss) if the position has non been liquidated. Y'all must close a position to realise turn a profit or loss in your trading account. It is and then you may calculate the turn a profit or loss.

Profit and Loss Calculation:

The basic calculation involves multiplying the position size (units traded) past pip movement, or simply multiplying the pip value by pip movement. While many prefer the ease of a Forex calculator, agreement the dynamics behind the calculation is important.

If the quote currency is the aforementioned equally the account currency (USD).

Imagine EUR/USD increased to $1.2180 from $1.2160: a 20-pip gain. Since a standard lot size in Forex is 100,000 units, if you had bought 3 lots and closed the position, you made 600 USD (300,000 10 0.0020). Some other way to calculate this is by multiplying the pip value by the price movement (30 USD x xx pips).

If you entered iii mini lots (30,000 units), the same price movement nets 60 USD (30,000 x 0.0020 or 3.00 USD [pip value] x 20 pips). EUR/USD dipping 30 pips in the same position, a loss of ninety USD would be realised.

An account currency denominated in euro trading the EUR/USD.

Using the same EUR/USD exchange rate, assume a 50-pip rally lifts the currency pair from $1.2160 to $1.2210. The pip value for ane standard lot is 8.22 EUR. Therefore, multiplying the pip value by price movement (8.22 EUR x 50) equals 411 EUR turn a profit.

You can too multiply the trade size (in euros [100,000 / 1.2160) past pip motion (82,240 ten 0.0050).

An business relationship currency not included in the currency pair (GBP) – presume the GBP/USD charge per unit is $1.3532.

Again, using the same EUR/USD rate as to a higher place, a rally from $1.2160 to $one.2190 equals a 30-pip move. The pip value for ii mini lots is one.48 GBP. Therefore, a xxx-pip proceeds or loss equates to approximately 44 GBP (ane.48 GBP x 30).

Yous may as well calculate profit/loss past multiplying trade size (in GBP [20,000 / 1.3532]) past pip move (14,779 x 0.0030).

Disclaimer: The information contained in this material is intended for general advice just. It does not take into account your investment objectives, financial situation or item needs. FP Markets has made every endeavor to ensure the accuracy of the data equally at the date of publication. FP Markets does non give whatever warranty or representation as to the material. Examples included in this cloth are for illustrative purposes but. To the extent permitted by police, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by fashion of negligence) from or in connexion with whatever data provided in or omitted from this textile. Features of the FP Markets products including applicative fees and charges are outlined in the Product Disclosure Statements bachelor from FP Markets website, world wide web.fpmarkets.com and should be considered earlier deciding to deal in those products. Derivatives comport a loftier level of gamble; losses can exceed your initial payment. FP Markets recommends that yous seek independent investment advice. Kickoff Prudential Markets Pty Ltd trading equally FP Markets ABN xvi 112 600 281, Australian Fiscal Services License Number 286354.

How To Calculate Profit In Forex,

Source: https://www.fpmarkets.com/blog/how-to-calculate-profits-and-losses-of-forex-trades/

Posted by: theriaultthestoat.blogspot.com

0 Response to "How To Calculate Profit In Forex"

Post a Comment